The multi-stage procedure for dissolving and deleting a company can be outlined as follows:

Liquidation GmbH or UG (haftungsbeschränkt)

If you wish to dissolve/terminate your company, please use our thematic questionnaires or contact us directly.

Liquidation GmbH/UG

Dissolution of a GmbH

Resolution on dissolution: The end of the GmbH begins with a reason for dissolution (§ 60 GmbHG). In most cases, this is a resolution to dissolve the company. In it, the shareholders resolve to dissolve the GmbH. The resolution specifies the date on which the GmbH will cease its business activities and from which the company’s assets are to be realized. It requires a majority of 3/4 of the votes cast, unless the articles of association stipulate otherwise. The GmbH is not yet finished with the resolution. However, the object of the company is changing. To put it bluntly, the corporation is turning from an “active corporation” into a “dying corporation”. The liquidation resolution should also determine the liquidators (in most cases the previous managing directors) and the safekeeping of the business documents.

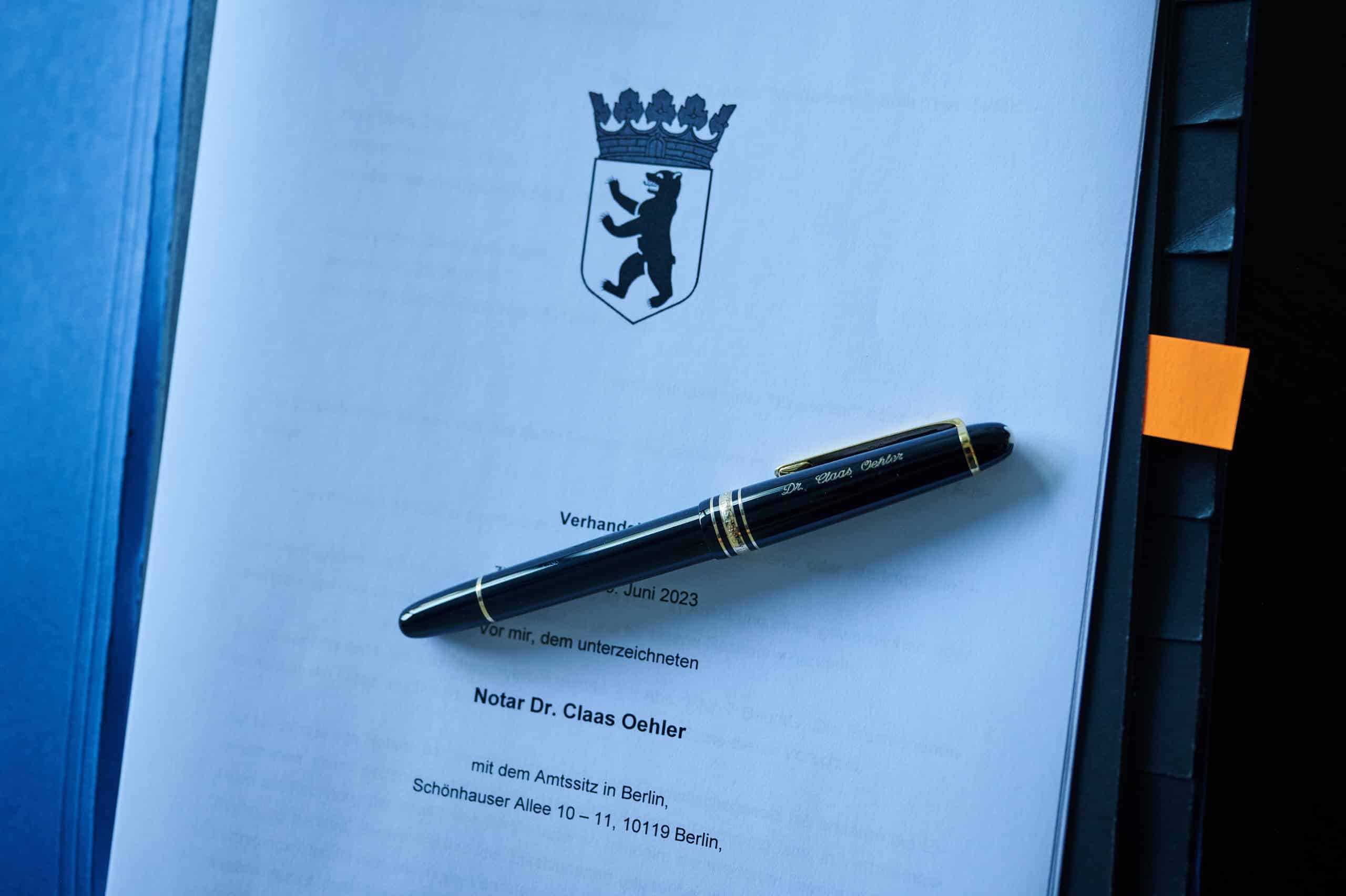

Registration with the commercial register: The resolution to dissolve the company and the liquidators must be registered with the commercial register. The first liquidators and their power of representation must be notified by the managing directors; any change in the liquidators and any change in their power of representation must be notified by the liquidators for entry in the commercial register (Section 67 GmbHG). The application (or the signatures of the applicants) must be notarized. The entry serves only to make the company public; the company (actually the liquidators) must use an addition (“i.L.” or “in liquidation”) from this point in time to make the liquidation recognizable (§ 68 Para. 2 GmbHG).

Publication of the dissolution: The dissolution must also be published in order to give creditors the opportunity to register their claims. The liquidators are therefore obliged to announce the dissolution of the GmbH in the electronic Federal Gazette and to invite creditors to assert their claims. This initiates the so-called blocking period (blocking year), during which the company’s assets may not be distributed.

Winding up or liquidation: During liquidation, the liquidators terminate all ongoing business and turn the company’s assets “into money” in order to satisfy all of the company’s creditors. They draw up an opening balance sheet (§ 71 GmbHG) and, at the end of each year, annual financial statements and a management report.

Distribution of assets: Once all liabilities have been settled, the remaining assets are distributed among the shareholders in accordance with the closing liquidation balance sheet, but only after the lock-up year has been observed. (§ 73 GmbHG) The distribution is made in proportion to their shares if no special regulations (e.g. liquidation preference) are provided for.

Deletion from the commercial register: Once liquidation has been completed, the company is deleted from the commercial register. However, this presupposes that all of the company’s assets have been extinguished

Continuation/subsequent liquidation: A GmbH that has already been dissolved can be continued by a further resolution of the shareholders, at least before the company has distributed all of its assets. Legally, a company can only cease to exist when it no longer has any rights or obligations. If it turns out after the deletion that the GmbH still has assets, for example land register entries that have not yet been deleted, it can be reactivated by means of a supplementary liquidation (despite the previous deletion). A supplementary liquidator is appointed, who then sells this asset position.

Dissolution and liquidation of partnerships

Even the dissolution of a partnership does not lead directly to its end. Here too, the company enters a liquidation phase, which is governed by Sections 735 et seq. of the German Civil Code (BGB) for civil law companies and Sections 143 et seq. of the German Commercial Code (HGB) for commercial companies. This phase also serves to ensure that the company’s business is conducted properly.

In contrast to corporations, however, there is no fixed blocking year. Once this winding-up phase has been completed, the company is formally terminated and the company must be deleted from the commercial register or, in the case of a registered BGB company (eGbR), from the company register. Both the dissolution of the company and the completion of its liquidation and deletion must be registered in the commercial or company register in accordance with Sections 141, 147, 150 HGB for commercial companies or Sections 733, 736c, 738 BGB for BGB companies.

Write us an e-mail or give us a call.

In special constellations, other variants of deletion are also conceivable (flash deletion, merger with the sole shareholder), but these are only recommended in exceptional cases.